Seraphim 2Q2023 Report Shows Space Investment Returning

18th Jul 2023

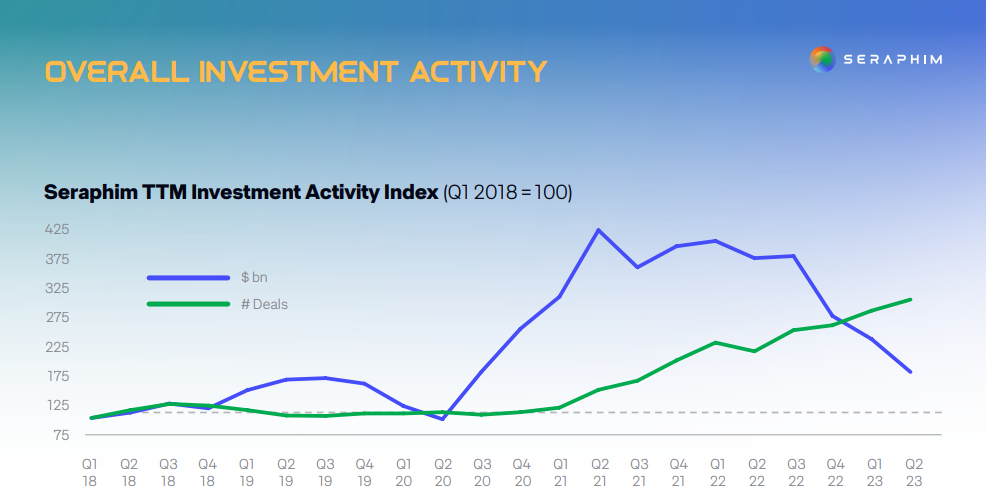

After ending last year in a downturn in space investment, the first half of 2023 showed the industry is getting back on track. The Seraphim 2Q2023 report analyzing the space sector during the year’s first half uncovered the rebound.

While returning to growth has been slow due to cautious investors, especially in the United States, the space sector is seeing a rise in unexpected investment, particularly in Beyond Earth technology.

Recovery from slow 2022

In 2022, Seraphim said it was considered a year of “economic pullback”. Space tech investment declined 25% compared to 2021 – the biggest year for NewSpace. However, 2023 has shown promising signs.

“Activity remains strong, particularly at the early stages, with the number of Seed deals growing almost 55% increase year on year,” Seraphim said. “Considering this quarter in isolation, while the number of deals is down by around 30%, capital deployed is largely aligned with Q1 2023. This is indicative of cautious return to growth by investors, with an uptick in Series C stage deals.”

Beyond Earth investment grows

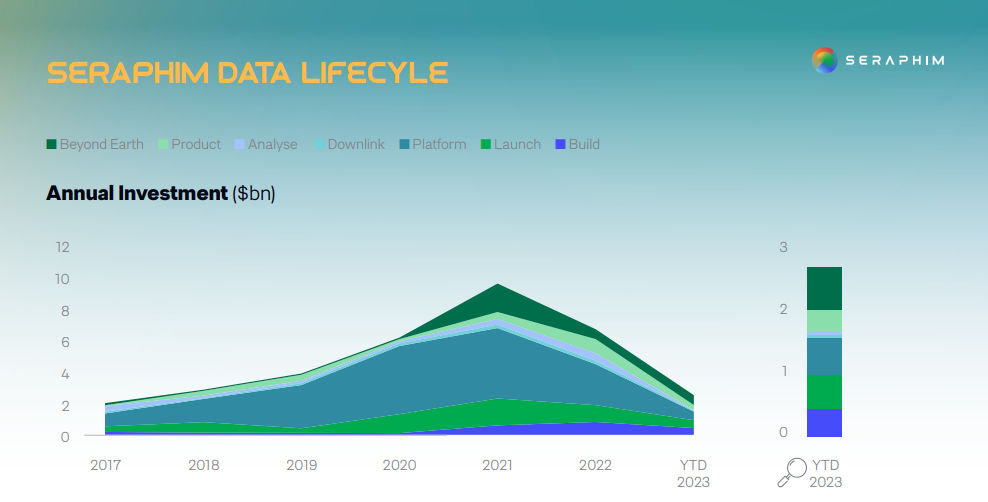

In the past few years, between 2017 and 2022, platform investments such as Earth Observation and Communications dominated the space sector, especially due to mega-constellation growth. Even at the beginning of the year, Seraphim predicted many companies would continue to set their sights on direct-to-mobile connectivity from space.

However, Seraphim claims there has been a “pullback” from investment in this segment, and has seen more growth in Beyond Earth tech, which was also predicted by the company earlier in 2023. Beyond Earth includes technologies and infrastructure that perform in-space services for satellites and launchers.

“Theoretically, in this environment, investors should be avoiding capital intensive businesses such as Beyond Earth, which can involve large infrastructure projects in space. This is not proving to be the case: in the first half of this year Beyond Earth attracted the most investment,” Seraphim claims.

Some of the biggest deals in the first half of 2023 were with Beyond Earth companies, including US-based Constanellis Aerospace and Sierra Space, and Japanese company GITAI.

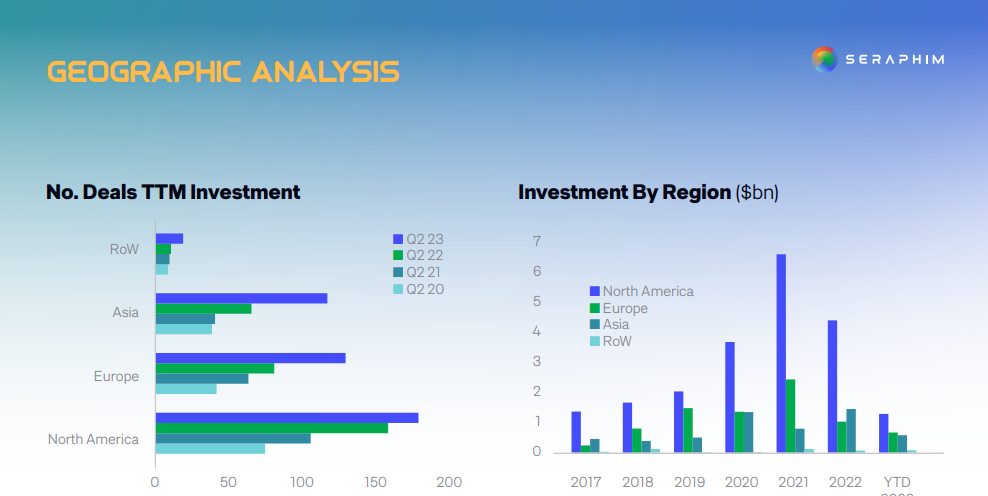

Rest of World beat out US on investment

The US has always dominated the space industry when it comes to investment, government budget, and activity. However, the most recent TTM (Trailing Twelve Months) period shows that the Rest of World (ROW) exceeded the US in space investment. This is mostly due to a 65% retraction of US investment this year.

However, the second quarter of this year saw the US return to its dominion in the sector, after increasing 72% from $421 million in Q1, to $724 million in Q2.

“As well as deal volume, US continues to lead in magnitude, with deal sizes around twice the size of those in Europe. Although the US has ‘reclaimed’ the top spot, momentum built around European investment has not diminished,” Seraphim explained. “European deals numbers have grown by 60% over the prior TTM (Trailing Twelve Months) period, and Asia grew by 79%. SpaceTech deals are increasingly represented globally with Asia making a mark.”

Thank you for your comment! It will be visible on the site after moderation.