Estimating the Impact of UK Investment in ESA – Is It a Win-Win?

21st Feb 2023

ESA receives about 75% of the UK Space Agecy’s (UKSA) annual budget, and some of the Brexit advocates might wonder why don’t we spend all of the money solely on the national space sector. The report prepared by Technopolis on behalf of the UK Space Agency dives deep into the impact of UK investment in the European Space Agency (ESA) and explains how financial contributions to ESA benefit the UK and why the cooperation of the two organisations is vital for both the EU and the UK.

How much does the UK Commit to ESA?

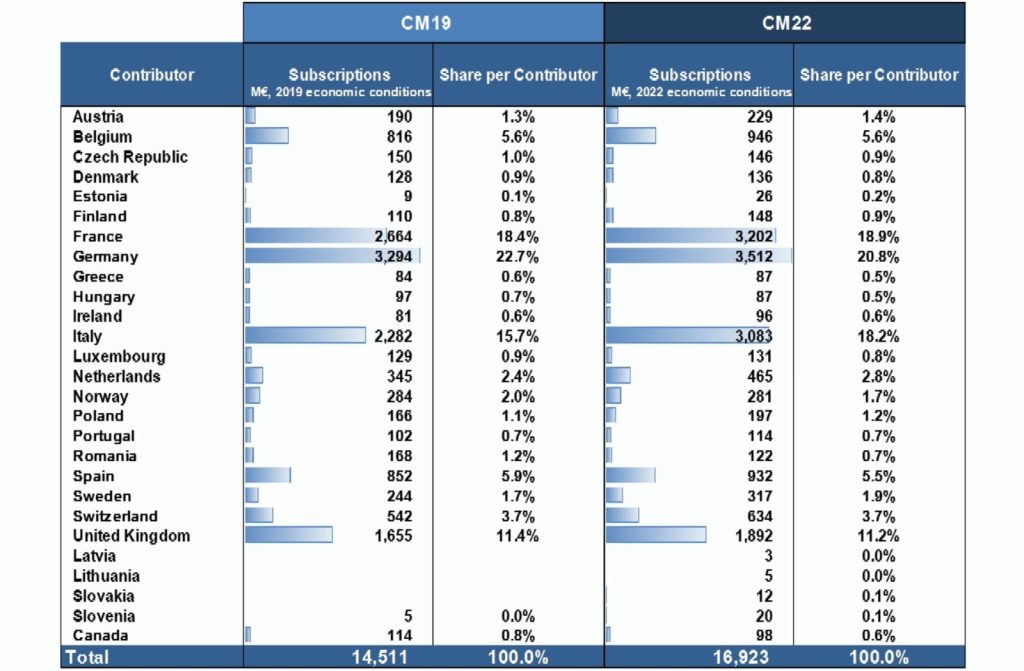

ESA is an intergovernmental organisation with 22 member states, including the UK. Each year, ESA members contribute to the mandatory programmes in compliance with their Gross National Income (GNI). In 2022 ESA’s annual budget was about €7.2 billion. During the five-year investment period that the ESA Ministerial Council accepted in November 2019 (CMIN19), the UK contributed €420-450 million each year, which was slightly above 11% of the ESA’s annual budget. As a result, the UK was one of ESA’s leading contributors in terms of funds, following Germany, France, and Italy. The situation remains similar after the 2022 ESA Ministerial Council, where a budget increase was negotiated for the next few years. The UK will still remain one of the largest ESA donors (though Germany, Italy and France will contribute up to two times more).

But why does ESA needs so much money, and what does it spend it on? That’s a good question. The thing is that ESA has a worldwide staff of more than 2,000 people and a bunch of ambitious scientific projects that require a lot of money. Yes, space is not only hard but also expensive. Let’s examine it closer.

Within its five-year CMIN19 investment period, ESA has agreed on eight core programmes.

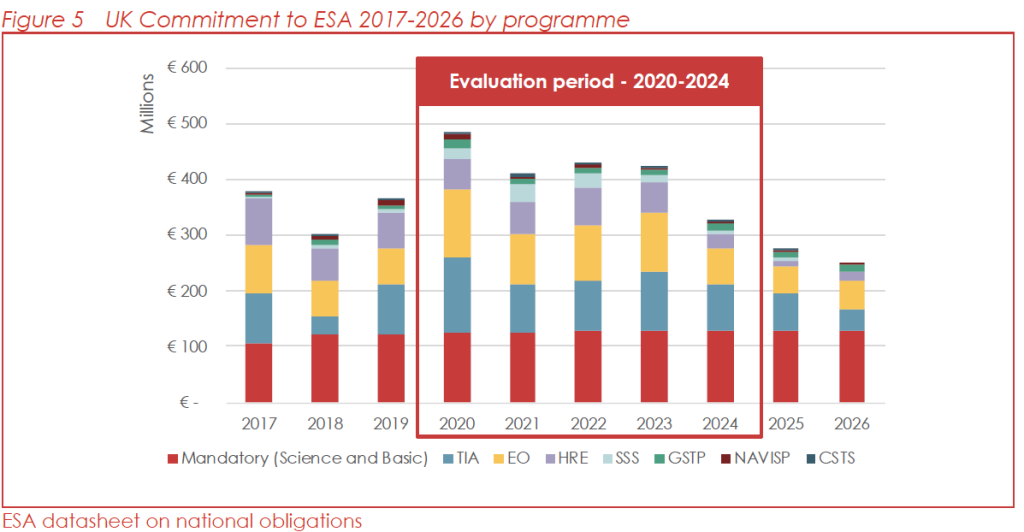

The four large ESA programmes – Space Science (and the mandatory ‘Basic’ activities), Telecoms and Integrated Applications (TIA), Earth Observation (EO) and Human & Robotic Exploration (HRE) – account for 90% of the planned expenses for the 2020-2024 period. In such a way, the UK focuses on the most important domains, such as TIA, which plays a key role in supporting the UK’s commercial satellite communications businesses. At the same time, it doesn’t spend much on commercial space transportation services, perhaps, hoping to support its local rocket companies.

The UK’s funding of ESA projects is not just about giving, it’s also about receiving. But with the space industry, benefits come over a longer term. When we’re talking about science, it’s impossible to expect profit soon after investments. Sometimes, it might take 5-10 years to see the results of the commitments made decades ago. The report calculates that each £1 million invested into ESA will generate a return of £11.8 million over time. London Economics also estimated ROI for the space industry subsectors in 2015.

| Direct Benefits* | Spillover Benefits* | |

| Earth Observation | £2-£4 | £4-£12 |

| Telecoms | £6-£7 | £6-£14 |

| Navigation | £4-£5 | £4-£10 |

| ESA Membership | £3-£4 | £6-£12 |

However, the United Kingdom can already feel the early results from the cooperation in terms of economic growth, scientific value, and levelling up. So, the deal is worth waiting for, right?

How does ESA help the UK to Achieve the National Strategy Goals?

A year ago, the UK government presented the National Space Strategy, a document which defines and describes the vision of developing the space sector in the UK. The manifest was full of inspiring messages, like plans to make the United Kingdom one of the most innovative, scientific, and successful space economies in the world. It also contains numbers and figures proving the importance of the space sector to the prosperity of the country. The UK Space Strategy specifies five goals for becoming a super-space nation:

- Goal 1: Grow and level up our space economy

- Goal 2: Promote the values of Global Britain

- Goal 3: Lead pioneering scientific discovery and inspire the nation

- Goal 4: Protect and defend our national interests in and through space

- Goal 5: Use space to deliver for UK citizens and the world.

These are the key points of the Strategy that define further coordinated action from the government. International collaboration, science and technology development, growth in the space sector, and resilient space capabilities and services are the pillars of the UK space plan for the decade.

How does the UK benefit from collaboration with ESA?

Cooperation with ESA is on the list of priorities of the UK Space Agency in order to draw knowledge, investments, and prosperity to the country and spread its influence on the space industry globally. And these are not just words. Considering commitments made at the ESA Ministerial Council in late 2019 (CMIN19), the report illustrates a bunch of benefits for both the UK and ESA. And with a 17% increase in ESA’s budget in 2022, returns might be even higher.

ESA partners have big hopes for the future socioeconomic advantages of the missions implemented with the help of a joint budget. These include benefits to health, welfare, utility, environmental preservation and the security of space assets, as well as the security of assets on Earth, productivity, and improved public policy design and delivery.

Knowledge

Space exploration and gaining knowledge about our planet, Solar System, and Universe have always been the primary goals of ESA’s Science, EO and HRE programmes. The James Webb Space Telescope (in conjunction with NASA) and Solar Orbiter, two missions within the science programme, are the most famous examples of scientific missions that were launched at the start of CMIN19. However, Solar Orbiter is just starting to produce data.

More missions are yet to be launched, including JUICE, Euclid, HydroGNSS, and CO2M, along with others that will be released during the next investment periods (e.g. ARIEL, TRUTHS, Vigil, ESPRIT Re-fuelling). With the help of such missions, space agencies increase their influence, improve their reputation, and even can make history with some scientific discoveries.

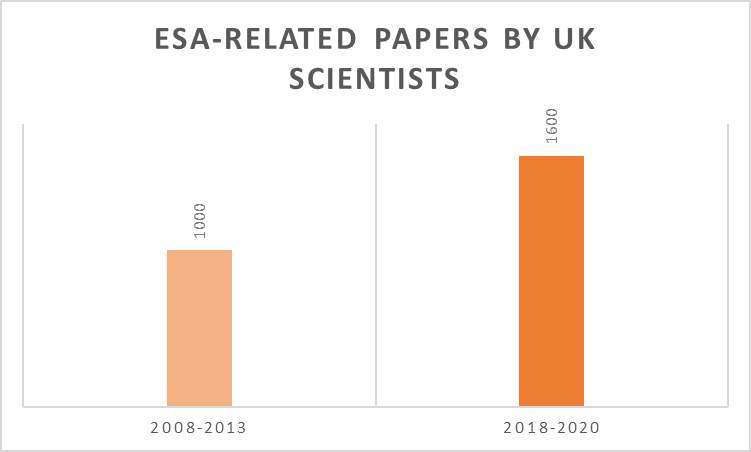

As related to knowledge, participation in ESA brings the UK some advantages to its national scientific community. Since 2016, there has been an increase in the number of ESA-related papers published by UK authors (i.e., with at least one UK author for each paper), going from a relatively consistent 800-1,000 papers per year between 2008 and 2013 to c.1,600 during the period from 2018 to 2020. A total of 75% of the papers could be classified into topics that relate to particular ESA programmes, and of these, 84% were related to the Science programme.

Finally, the space industry requires a wide range of skills, some highly specific, i.e., the manufacturing, operation and use of space infrastructure, and others more generally applicable. According to the survey of ESA contractors, 45% of participants indicated an increase in skills in 2018-2019 and 89% in the period from 2020 to 2021.

The active development of the space industry and successful missions, such as the James Webb Telescope launch, encourage young talents to think about careers in space science or the wider array of STEM fields. In such a way, we could observe an increase in interest among the youth in STEM careers, which is a result of efforts to demonstrate that they can be a part of some scientific discoveries not only abroad but also by staying in the UK.

Prosperity

Efforts at innovation in the creation and application of ESA mission and technology are anticipated to lead to increased prosperity through UK investments in ESA.

ESA contracts provide funding for either the creation of hardware and software technologies for specific space missions and infrastructure (spacecraft, operations, data management, etc.) or the creation of new technologies that have the potential to support future space activities. Thus, participation in ESA contracts may lead to new connections, networks, and reputational benefits, ultimately resulting in strategic new partnerships and enabling access to wider space markets and export-led growth.

Through the contracts, ESA aims to build a thriving and competitive space industry in all ESA member states, the UK included. According to the survey of ESA contractors, the technological expertise, knowledge, and skills gained through contracts are expected to result in new products and services for the commercial and institutional market and lead to new market entry, with subsequent impacts on sales and employment.

The benefits of ESA contracts (new skills, technologies, products, etc.) may play a key role in the wider patenting behaviour of both ESA contractors and the wider UK space sector.

“If we get this right, the UK space sector could provide the basis to help energise an economy emerging from recession, and create 100,000 new jobs over the next 20 years in an industry that already provides tangible economic and societal benefits,” – Andy Green, CEO of Logica and Chairman of the Space IGT, thinks.

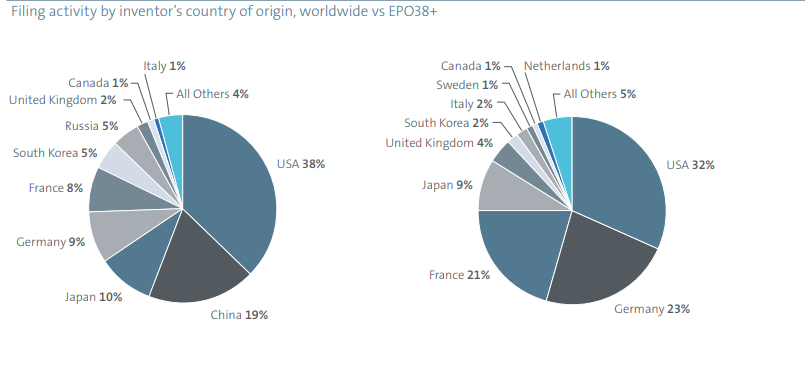

According to data from the 2021 EPO Patent insight report on astronautics, the UK accounts for just 2% of space-related patents, ranking 8th behind the USA (which accounts for 38% of patents granted), Japan, China, Germany, France, South Korea and Russia. With more active ESA participation and more effort into developing space-related projects and products, the number of patents in the UK space industry could potentially be growing.

Security and protection

The United Kingdom is a big contributor to two relatively minor programmes, SSS and CSTS. Both are obviously in line with the UK’s national priorities for space security, including a national launch capability and protecting space assets from debris and defending terrestrial infrastructure from abnormal space weather. The UK has participated in the SSS programme since its creation in 2009 and is the largest contributor, with a €96.8 million investment in CMIN19, which accounts for 22% of the overall budget.

Participation in ESA is expected to provide the UK with increased security and protection through

It is anticipated that membership in ESA will boost security and protection for the UK through:

- ‘Security in space’ by providing safe access to space, clear and up-to-date regulations, a sustainable space sector and secure and resilient space assets in space, especially in terms of providing critical national infrastructure (CNI);

- Enabling the development and implementation of effective state policy and state services.

Global influence

The UKSA participates in all of ESA’s formal governance structures. The UK has a significant influence on ESA as the organisation’s fourth-largest investor (out of 22 member states), contributing 10% to the overall budget in the CMIN19 period.

Additionally, the UK plays a significant role in the formulation of ESA’s long-term scientific plan, Voyage 2050, and is disproportionately overrepresented in the scientific advisory bodies of the agency. For instance, former Chief Executive of the UK Space Agency David Parker occupies the position of Director of Human and Robotic Exploration, while Carole G. Mundell, a British national, has been recently appointed as Director of Science. ESA is among the top three largest civil space agencies in the world, which gives the UK an additional opportunity to influence not only local space activities but be a major player in the global space market, too.

The United Kingdom is a strong and frequently leading contributor to the development of concepts for science missions, both in terms of research design and the design and building of scientific instrumentation. However, it doesn’t seem to be enough, according to the survey, ESA contractors want to see more UK leadership and influence: only 50-60% of ESA contractors agree that the UK is well-represented within ESA senior leadership and that the UK’s space sector’s capabilities and needs are reflected in ESA strategy. That’s something the UK authorities can and should work on

ESA added value

The first two aspects of ESA’s added value from the UK’s perspective are the amount of public spending in space and what economists refer to as the indivisible nature of civil space. When it comes to the development of space missions, the projects take 10–20 years and billions of euros from start to finish, while the cooperation with ESA gives the UK the ability to benefit from the joint space missions and budget. In some cases, separation is not the best option for progress. The UK government, for instance, determined that the estimated £3 billion to £5 billion cost for a UK replacement for the European satellite positioning system (Galileo), access to which was lost as a result of Brexit, was too expensive and the country is currently looking for alternative ways to access the necessary capabilities.

Competing with other agencies alone is only possible with budgets like NASA’s ($20 billion annual budget in 2018) or the China National Space Administration’s ($10 billion annual budget in 2018). By contrast, the UK’s budget of around £0.5 billion in 2018 (75% routed via ESA) is relatively small, even within Europe (below the budgets of France, Germany and Italy).

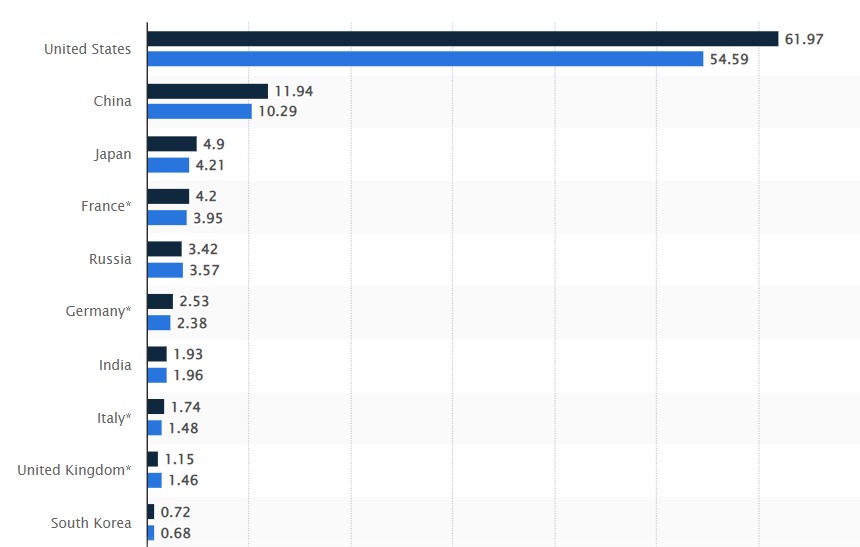

Regarding more recent government expenditures on various space programmes, the situation doesn’t look very different. UK’s investment of around $1.15 billion in 2022, including British investments in ESA, is one of the lowest among the major countries. At the same time, Italy, India, and Germany that are all actively working on their space capabilities, all spent more than the UK, not to mention the United States and China which have traditionally spent billions of dollars on space projects.

The UK’s participation in ESA is still the greatest strategic option for international space cooperation. The general consensus is that the UK will do more outside of ESA in the future but that these broader activities will be complementary to the UK’s commitments to various ESA programmes. Additionally, ESA offers the UK a crucial pathway to international space missions, including those in partnership with China, Japan, and the USA (e.g. ISS, Lunar Gateway, SMILE). The National Space Strategy confirmed this ESA-plus vision.

Economic assessment

Implementing dreams about space and establishing a reputation as one of the most technically advanced countries in the world is not enough for the prosperity of the country. So, the economic benefits of the UK-ESA activities should also be considered.

Based on predicted spending for the CMIN19 investment period, the Technopolis report estimates that the overall return on investment from CMIN19 will be 1:11.8 in terms of GVA, meaning that each million spent will eventually yield a return of £11.8 million. In addition, the total net revenue increase is expected to be £5.75 billion (in cash terms) between 2020 and 2036, or £0.50 billion annually, after deducting the projected costs of the CMIN19 investment period (£1.69 billion).

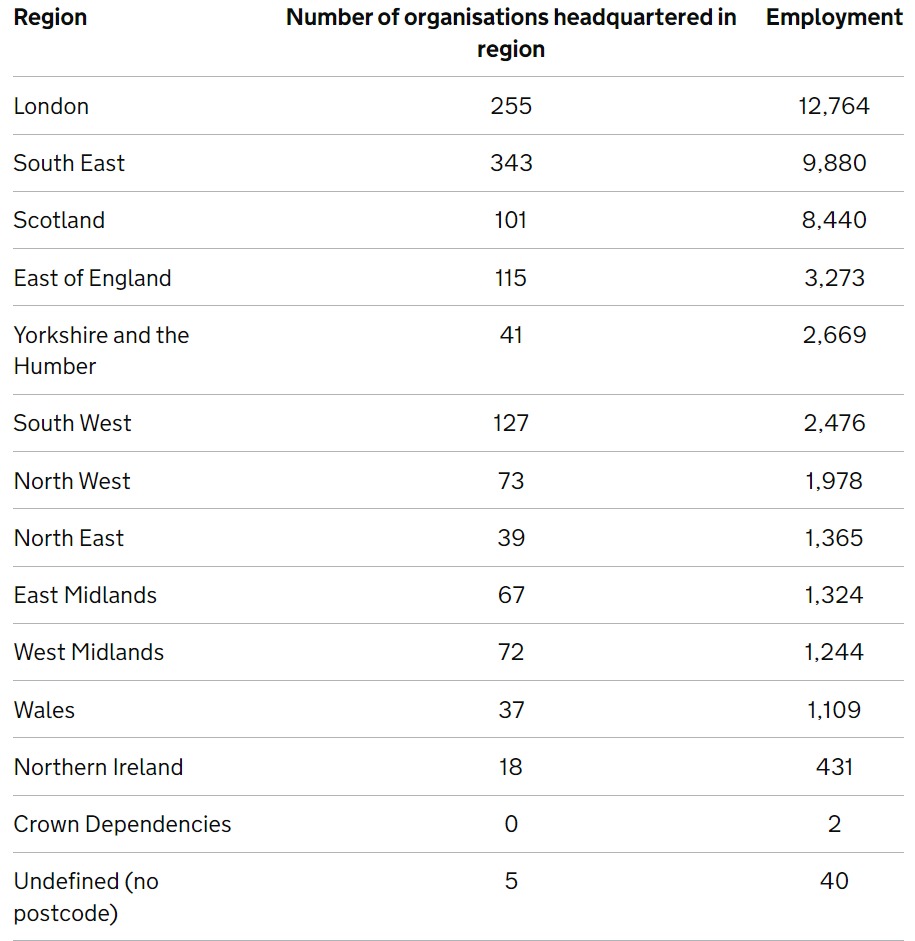

The collaboration with ESA also brings employment perks. It is estimated that the projected costs for the CMIN19 investment period (£1.69 billion) be 16,524 person-years of employment. For reference, total employment in the UK space industry was 45,000 in 2020, based on headcount, suggesting that supporting employment through ESA contracts will be an important driver to support and sustain employment in the sector during the next 3-5 years. Together with the Levelling Up Programme, new employment opportunities should also bring more even distribution across the UK regions, bringing economic development to new areas.

According to the Size and Health of the UK Space Industry 2021 report, space employment grew 6.7% from 2018-2019 and comprised 0.14% of the UK workforce in 2019-2020. The space industry contributed £6.9 billion of direct gross value added (GVA) (0.31% of UK GDP) and £15.8 billion total GVA across the supply chain.

“Today, we have a clearly defined opportunity to grow the UK’s share of the global space market to create a world-leading £40 bn UK space industry by 2030”, – Andy Green, CEO of Logica and Chairman of the Space IGT, said.

Contributing to net-zero

Space-enabled EO technology has been crucial in helping us better understand and monitor climate change. It remains the main focus of ESA, UKSA, NASA and many other global organisations. While these initiatives don’t actually reduce CO2 (or other greenhouse gases) in the atmosphere, they are crucial in tracking worldwide progress towards net zero.

Greenhouse gas (GHG) emissions are one of the most discussed challenges in the space industry. The scale of the space sector is relatively small compared to other industries. Still, at the same time, it has an enormously high carbon footprint when compared to many other economic sectors. The space industry is also contributing to climate change through its need to launch spacecraft, albeit this is very much less significant than the carbon footprint of manufacturing.

UKSA follows the ESA’s strategy of improving our understanding of climate change, as well as focusing on the sustainability and environmental performance of space activities. UKSA can keep supporting ESA’s clean-space activities, which focus on reusing space hardware and using more ecologically friendly fuels (Orbex and Skyrora), as well as smaller projects searching for methods to reduce the space industry’s carbon impact.

Levelling-up

The UK actively works on the levelling-up programme, a comprehensive “system overhaul” in how government operates as outlined in the Government White Paper on Levelling Up (February 2022). While the UK government has actively supported regional economic growth for most of the last two decades, the levelling-up agenda represents a stronger commitment to a more evenly divided geographical distribution of influence and activity. Four regions are home to the majority of ESA-related space activity and employment. 78% of contractors were located in London, the South-East, the South-West, and the North-West in 2020–2021.

Given the strict entry requirements, it is unlikely that the geographic distribution of ESA contracts will change significantly anytime soon. The major players and new inward investors continue to perceive the UK as a significant spacefaring nation despite Brexit and its consequences on the UK industry’s access to the numerous EU flagship space activities being carried out through ESA.

Outputs and outcomes of ESA programmes for the United Kingdom

As we mentioned at the beginning, ESA has eight domains for investments and development: Space Science, Telecoms & Integrated Applications (TIA), Earth Observation (EO), Human & Robotic Exploration (HRE), General Support Technology Programme (GSTP), Space Safety and Security (SSS), Navigation Innovation and Support Programme (NAVISP), and Commercial Space Transportation Services (CSTS).

Here’s what these programmes offer to Britain and how commitments to ESA benefit the UK.

Science (mandatory programme)

The programme has two major goals:

- to maintain Europe’s expertise in space by providing the scientific community with the most advanced tools available;

- to contribute to the long-term sustainability in space by supporting technological innovation in industry and science communities and maintaining launch services and spacecraft operations.

As a mandatory programme, the UK commitment has been relatively stable over time, though an uplift was agreed at CMIN19 – of the order of €85-87 million per year. The UK national programme to support instrumentation development is of the order of £23 million per year.

As a result of the European Space Agency Council of Ministers meeting in 2022, the UK additionally committed £615 million to ESA’s core space science budget, securing opportunities for UK companies to bid for high-value contracts and establishing new scientific leadership roles for UK universities. Upcoming ESA science missions range from hunting for rocky Earth-like planets outside our solar system (Plato) to sending the first gravitational wave observatory into space (LISA).

Through its involvement in this ESA programme, the UK hopes to accomplish the following goals:

- To be a participant and lead research and discoveries in the fields of astronomy and space that have global meaning,

- Make sure the UK companies have a chance to compete for high-value mission contracts,

- Shape and lead ESA missions on behalf of national interests. UK Space Agency is a very valuable and influential ESA member for several reasons: it is a leader in scientific programmes and is one of the biggest contributors to the alliance. Between 2020 and 2022, 31 ESA contracts were signed with UK organisations for €15.3 million.

The UK has a role in some shape or form in all eight ESA missions under development during the CMIN19 investment period, plus the joint missions with NASA (James Webb Space Telescope) and China National Space Administration (SMILE). The country has leading roles in Solar Orbiter, ARIEL, PLATO, Comet and SMILE and is contributing instrumentation to all other missions.

This high level of scientific engagement reflects the UK’s extensive experience and reputation in space science and instrumentation, as well as the country’s leadership role in ESA’s Science Programme. by participating in the ESA science programme, the UK demonstrates its scientific and technological capabilities and skills in the space sector. Being a successful space nation is an illustration and symbol of advanced technological competence that inspire most developing economies to strive for the same level of recognition.

Telecoms & Integrated Applications (TIA)

The main goal of the Telecommunication and Integrated Applications (TIA) programme is to conduct research and development (R&D) activity and provide innovations in the sector, which do not always bring some economic benefits and viability.

The UK is a global leader in satellite telecommunications, and in 2018, telecommunications and applications (excluding direct-to-home broadcasting) made up 40.5% of UK Space revenues.

There are several core reasons why the UK participates in the TIA programme:

- To develop national space technology & capabilities;

- To make the UK an attractive spot for a space business;

- To enhance the UK space sector.

The main outputs to date, highlighted by interviewed contractors, have been technological progress.

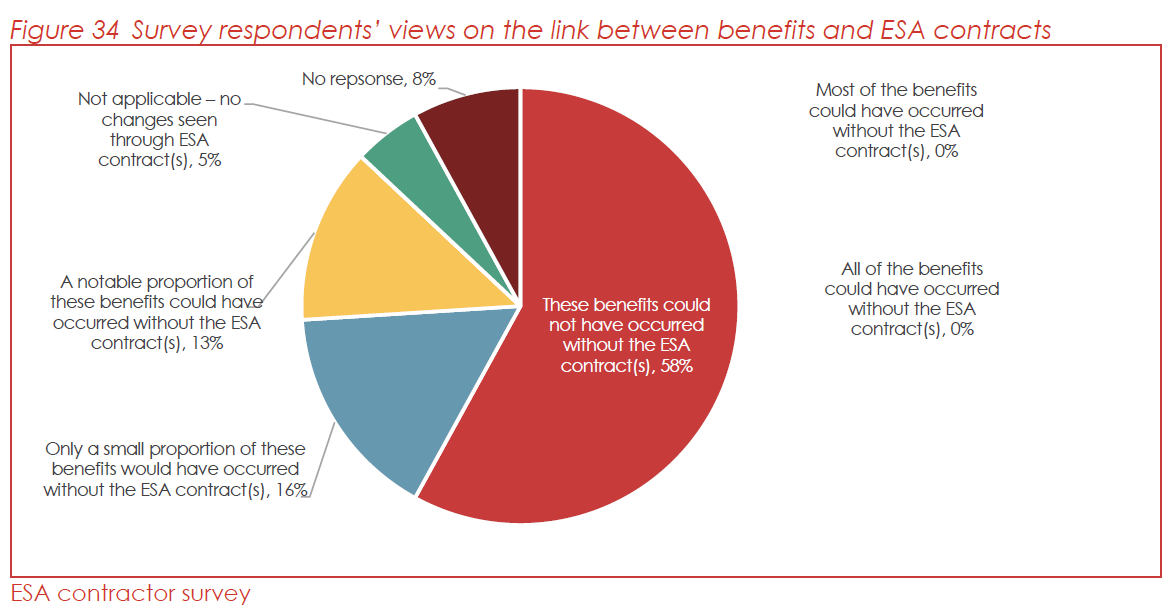

Results from the surveys confirm that ESA is crucial for enabling the advantages that come from initiatives funded by the TIA. 87% of the 38 respondents said that ESA had contributed in some way to the benefits reported, with 58% saying that there would not be benefits at all without ESA contracts. It proves that the national space sector still relies on international cooperation with ESA member states, and it plays a vital role in the British scientific and economic domains.

Earth Observation (EO)

The UK is a key financial and scientific contributor to the EO programme, delivering 12% of its total budget throughout the duration of the five-year CMIN19 period. It’s hard to overestimate the importance of the Earth Observation technology nowadays, considering that EO missions play a key role in monitoring climate change by providing data on half of the internationally agreed-upon essential climate variable (ECV) and contributing to policies and activities to mitigate climate change.

ESA has invested heavily in Earth Observation since its inception with a view to advancing our understanding of the planet. During the CMIN19, the UK actively supports two major programmes and four smaller Earth Watch missions (one of which is TRUTHS, a UK mission proposal). The two larger programmes are Future-EO – which is a foundational programme aiming to prepare everything for future EO missions and covers data management; and Copernicus – the European Union’s Earth observation programme, which focuses on climate and environmental tracking.

Overall, the UK investments into ESA’s EO programme is a logical step following governmental strategy and interests, as ESA contracts help boost the UK space economy, strengthen international collaborations, and establish the UK’s position as a science and technology leader.

At the European Space Agency Council of Ministers meeting in 2022, held in Paris, the UK government committed up to £200 million to support the Earth observation sector as the EU continues to delay associated with the Copernicus programme.

Thanks to the cooperation of ESA and UKSA and their collaboration on EO programmes, we have a better understanding of climate change and, therefore, we’ll be able to develop a strategy for mitigating its impact and contributing to the Government’s Net Zero agenda.

Human & Robotic Exploration (HRE)

The primary goal of ESA’s Human & Robotic Exploration (HRE) programme is to manage Europe’s involvement in the human journey into the Solar System. While the final aim is human’s constant presence on the Moon and Mars, the programme focuses on building a strong base for future human missions through technological advancements and space-based infrastructure.

HRE is an optional programme among ESA projects, and the UK joined it relatively recently. They started cooperation in robotic exploration activities in 2005 and started contributing to human exploration in 2012.

Funding the HRE programme would allow the UK to play a significant role in the technological advancement of the international exploration effort. It guaranteed the UK crucial roles in the Mars Sample Return (MSR), the most important planetary science mission in the previous 40 years, in the development of commercial lunar communication and navigation services, and in the delivery of the ESPRIT component of the Lunar Gateway. Ensuring UK researchers gain access to special facilities on the ISS as well as satellites, rovers, and landers on the Moon and Mars is another goal of the initiative.

In general, the whole programme and its activities are to ensure Europe’s central role in the new era of global space exploration, strengthening European scientific excellence, boosting the competitiveness and growth of the European economy, encouraging international collaboration, and inspiring a future generation. This aligns with the UK’s goals in the National Space Strategy to build one of the most innovative and attractive space economies in the world and grow the UK as a space nation.

General Support Technology Programme (GSTP)

GSTP is part of a wider portfolio of ESA programmes across domain areas that supports space-related technology development. As an optional programme, GSTP requires the voluntary participation of ESA member states.

The UK space sector is heavily emphasised in the GSTP programme’s goals from the UK’s perspective. The UK space sector benefits greatly from early-stage support for technological development since it enables them to advance their technology more quickly, join the market more rapidly, and surpass their competitors while capturing a sizable market share.

It is anticipated that over time, the contribution to GSTP will assist the larger UK space sector. The technologies now being developed under GSTP will likely play a key part in the next ESA missions. Long-term investment through GSTP can strengthen UK space sector capabilities by bridging gaps and bolstering domestic supply chains in areas of vital national interest. Even while the space industry is expanding quickly, it is still relatively minor compared to other, more established sectors.

GSTP uses ESA expertise while assisting in keeping the UK at the forefront of technological advancement.

Space Safety and Security (SSS)

By establishing the Space Situational Awareness (SSA) programme in 2009, ESA focuses on monitoring space weather targeting for effective forecasting and the tracking of Near-Earth Objects (NEO), satellites and debris. The Space Surveillance and Tracking (SST) component of the programme attempted to control space traffic and track the movement of space debris to alert spacecraft operators of probable collisions. The SSA programme claimed a goal of improving space weather forecasting capabilities.

The programme is another component of implementing the UK’s space safety objectives, in which SSS participation is critical. Contracts awarded during the SSA period were used to create jobs, capabilities, and new software and hardware for the SSS programme.

Navigation Innovation and Support Programme (NAVISP)

The Navigation Innovation Support Programme is a new optional programme that addresses Europe’s broad developing position, navigation, and timing needs and opportunities.

By participating in the programme, the UK strives to maintain its leadership position in PNT (positioning, navigation and timing) and secure a position as a sector leader by stimulating innovations, new technologies, products, and services development.

The UK is also keen to support further investment at the Member State level and grow major downstream. The UK used to plan its own national programme similar to ESA’s NAVISP. Still, it was preferred to support the alliance as such cooperation brings better and faster results than starting similar projects from scratch. Overall, NAVISP supports 60% of UK SME primes and is represented as a programme that connects non-space enterprises with ESA.

Commercial Space Transportation Services (CSTS)

Because the UK has not traditionally invested in ESA launch programmes, it has relatively limited relevant capacity and capabilities. This is particularly since larger launch programmes like Ariane and Vega are more expensive and are not aligned with UK interests. However, the UK has participated in CSTS since its beginnings at CMIN19 because it wants to gain experience in space transportation and tap the large new market prospects.

The UK’s engagement in CSTS is focused on four contracts: two for launchers (Skyrora and Orbex) and two for prospective launch customers (D-Orbit, SpaceForge). If everything goes well, in the nearest future, the UK can substitute Soyuz rockets and become the main launcher in ESA.

The programme is considered to be a “win-win” for both the UK and ESA. For the UK, it develops competencies, attracts investment, grows resilience and improves sustainability, while for ESA, there will be benefits for the wider space ecosystem if it brings launch costs down.

Final words

Despite Brexit and separation from the EU, the United Kingdom remains one of the key players in the European space industry. It is a major contributor responsible for 11% of the ESA’s annual budget, which means its voice is loud and influential.

The UK is an active participant in ESA scientific projects, as well as Earth Observation, Telecoms and Integrated Applications, and Human & Robotic Exploration programmes. Having established its own set of goals and long-term vision within the National Space Strategy, the United Kingdom consistently supports the most winning initiatives in space. At the same time, Britain strengthens its own space economy and infrastructure as part of its Levelling-up programme.

Understanding the advantages of collaboration with organisations like ESA and NASA and their budgets, the UK has access to the most advanced technologies and research while it keeps enhancing its national space capabilities, including launch facilities, manufacturing sites, and private rocket companies. The UK has the potential to become the main supplier of space launches in Europe, offering its services to ESA and other players on the market.

Thank you for your comment! It will be visible on the site after moderation.