Investment in Space: Will the UK catch up with USA & Europe?

25th Oct 2021

German rocket manufacturer, Isar Aerospace got a welcome boost recently when it announced it was in receipt of a $75 million investment cheque from luxury car maker Porsche, which was in fact just part of an overall financing round totalling $165m. This gave Porsche (in their words) “a low single digit share in Isar”. So, let’s assume generously that they secured a 4% stake, that would value Isar Aerospace at $1.875 billion. But we suspect the percentage is more likely around the 2-3% mark which would then give us a market cap of at least $3.6 billion.

What stage are Isar Aerospace at?

The company was founded in 2018 and it seems they are developing a rocket named “Spectrum” that will carry up to 1,000 kg into Low Earth Orbit. And to date the company has yet to launch anything, although they have successfully tested their rocket engine and as far as we are aware have secured at least one payload contract. They have also secured an exclusive launchpad in Norway in a 20 year deal from where they will send their payloads into orbit.

The company’s first payload contract was secured in April of this year with Airbus Defence and Space.

With a valuation of that size, with very little in terms of revenue (presumably $0 other than the $180m total inbound investments), likely very little in terms of assets and a sales book flimsier than a sheet of Andrex quilted, we took it upon ourselves to see how space company valuations and multiples are panning out across the board.

If you look at SpaceX as an example, who have a whole bunch of rockets, launch sites, factories, floating landing pads, in-space transport vehicles and an order book that could choke a rhino, and who generate around $2bn in revenue per year, there current valuation is in the region of $73bn. Let’s call that 36x revenue.

This means that Isar would need to be generating $100m in revenue if we applied the same multiple. Which wouldn’t be an unreasonable amount to expect the company to generate. In fact it is quite easily feasible once they are in full swing.

If you also look at Virgin Galactic, who are publicly listed on the New York Stock Exchange, and have declared 2020 revenues of only $238,000 but have a market cap of $6.2bn things get even crazier. That is 26,000x revenue. Of course Virgin Galactic have a proven flight record (albeit none of it commercial as yet) and it would be a fair assumption to make that they are considerably more asset-rich than the likes of Isar Aerospace, but likely less asset-rich than SpaceX.

We understand that the three companies weve used here all have different business models, with Isar Aerospace focussed on sending satellites into orbit, Virgin Galactic transporting space tourists and SpaceX shifting both satellites and people into space, but they are all part of the “new space” category.

It should also be noted that Virgin did sell 600 tickets at $250,000, giving a total of $150m in sales sitting in their order book. However, the company did have to pause ticket sales after a fatal accident in which one of their pilots lost his life. Ticket sales have resumed at a higher price of $450,000. So, we can see that if VG had fulfilled those 600 ticket sales then their valuation would be closer in terms of multiples to that of Isar.

This does bring us to the conclusion that the revenue multiple is not the best way in which to value a space business, but rather a more speculative figure that looks at the potential future earnings of the company and the industry overall (which everybody and their dog expects to grow quite considerably over the next few years).

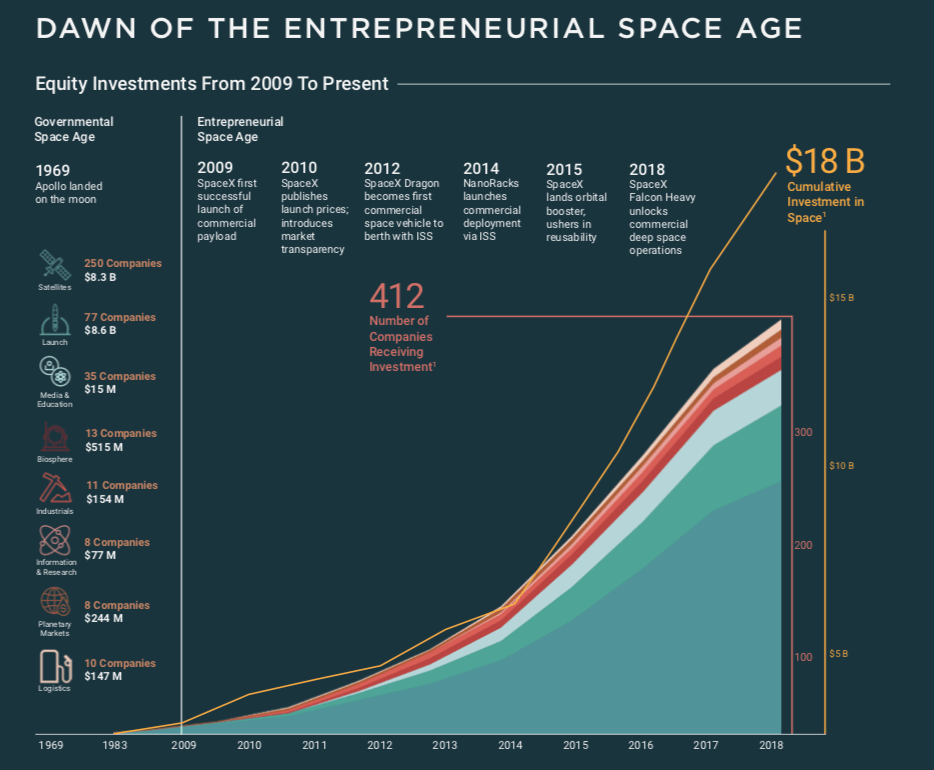

In fact, the space business is projected to become one of the biggest growth industries since the advent of the internet. Hence the huge amount of interest from investors. And it seems the returns are already potentially huge. You just need to check out his article by Seeking Alpha…

Also, just last year in a detailed analysis, Morgan Stanley Research predicted that the space industry would be the next trillion dollar industry…

https://www.morganstanley.com/ideas/investing-in-space

Looking at the UK’s space sector we see companies like Orbex Space who have attracted private investment (although an article we published previously provided no evidence of any of that investment in ‘actual cash’). In fact the company approached Highlands & Islands Enterprise for a loan of £675,000 to plug an operational blackhole recently. And the key partner (Lockheed Martin) in their consortium to launch at Sutherland Spaceport jumped ship and instead got behind Saxa Vord Space Centre in the Shetland Isles – taking their £23.5m with them.

Also the proposed spaceport up in Shetland attracted some ‘investment’ from private sources, which then disappeared once it came under the microscope. Although the company developing the Saxa Vord Space Centre seem to have come on leaps and bounds since then.

Other companies such as Edinburgh-based rocket builder, Skyrora appear to have been more public with their progress and most of their media coverage has been about milestone announcements and innovation launches rather than investment announcements. Although recent social media activity from Skyrora suggests they may be wooing potential investors in Dubai.

According to our financial expert these are all signs that a potential IPO (Initial Public Offering) could be on the cards for Skyrora. Only time will tell.

The Saxa Vord Space Centre have also shown signs that a potential IPO is on the cards and have attracted investment from the likes of Wild Ventures Ltd., a company owned by ASOS billionaire Anders Povlsen.

So, with US Aerospace giant, Lockheed Martin, Anders Povlsen and now Skyrora (who have committed future launches to take place at the Shetland facility), it’s looking like the good money is on that spaceport, and if they go down the IPO route any potential investors would be encouraged by those already getting behind the project.

The next two years will be crucial for the UK space industry and if investors are going to secure their share in its future we would need to see some significant movement to reflect what we see in mainland Europe and in USA in terms of equity across the private space sector. And if the US and European valuations are anything to go by… this could be big… very big.

Thank you for your comment! It will be visible on the site after moderation.