Small satellite launch market trends: what’s to come in 2021-2025?

12th May 2021

The international space industry has recently seen a significant increase in small satellite launch market demand for such vital tasks as Earth observation, communications and ground-based meteorological data. This trend was greatly facilitated by the development of space technologies, which made it possible to reduce the satellite size without losing its effective functionality.

The “Smallsats” category includes spacecraft with less than 500 kg weight, divided into five groups:

- minisatellites (100-500 kg)

- microsatellites (10-100 kg)

- nanosatellites (1-10kg)

- picosatellites CubeSat (consisting of 1-16 units and weighing 0.1-1 kg)

- femto-satellites (under 0.1 kg)

Over the next five years, the global smallsats market is projected to grow from $3 billion to $7.1 billion, at a CAGR of 20.5%. This will amount to approximately 1500-2000 satellite launches annually, with more than 80% of those consisting of minisatellites and CubeSats.

The increased deployment of satellite constellations is the primary reason for such an increase in total satellite numbers. SpaceX alone has increased the number of its Starlink mini satellites in orbit by nearly 1,000 over the past year. But besides Elon Musk’s company, there is also OneWeb, Blue Origin, Facebook, PlanetLabs, AAC Clyde Space, and others, working on their own satellite constellations in space.

Small Launch Rockets for Small Satellites

Such explosive growth in the number of small satellites predictably stimulates the demand for launch vehicles to deliver them into orbit. Today there are about 100 rocket companies worldwide, and their number continues to grow. Only a few, mainly state-owned, enterprises of the leading space countries, such as the USA, China, Russia, India, and the European Union can provide launch services. The rest, mostly private companies, are still in the development and testing stages.

However, in the next two years, more than ten companies promise to make their lightweight rockets, with 150-1,000 kg payload capacity, launch-ready. Some top examples are British-based Orbex and Skyrora; Australian Gilmour Space; German ISAR Aerospace and Rocket Factory Augsburg; Spanish PLD Space; American Firefly and Astra Space.

Lightweight rocket benefits are becoming ever more evident: low production and infrastructure cost, short production cycle, fast preparation for launch, high launch frequency, low requirements for launch sites and a prime location.

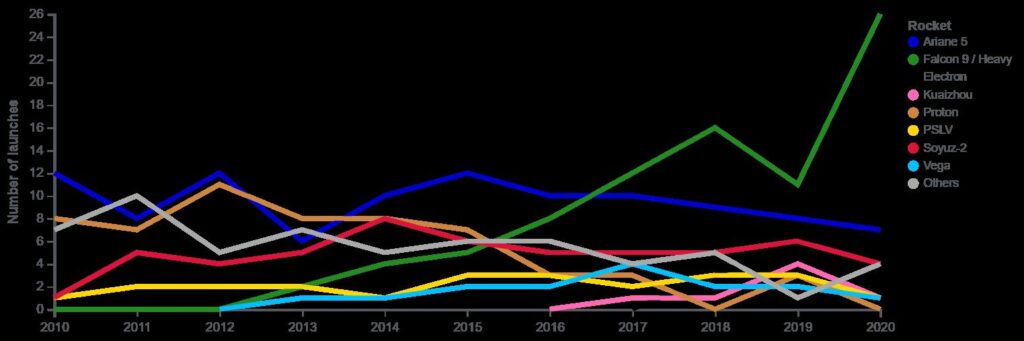

But while promising companies are only estimating their future benefits, the top ten smallsats launches over the past ten years looks like this:

Image Source

- Ariane 5 and Vega are designed by the European manufacturer ArianeSpace and are launched on behalf of the European Space Agency.

- Falcon 9 and Falcon Heavy belong to SpaceX and are launched for the USA’s commercial and defence purposes.

- Electron is a lightweight rocket by another private company, Rocket Lab USA.

- Proton and Soyuz are Russian-made rockets used by Roscosmos and ESA.

- Kuàizhōu and Long March are Chinese launchers that compete with the US in the number of launches.

- PSLV is an Indian series of rockets developed by ISRO.

Estimated Small Satellite Launch Market Demand

There are three main types of smallsats delivery into orbit:

- dedicated launch – deploying one or several satellites for one customer.

- hosted payloads – integrating additional payload with the main one.

- Rideshare – deploying two or more customers’ payload with one launcher.

Dedicated launch is becoming ever less profitable for the customer due to high service costs. In this case, customers have to cover the full launch cost, which today ranges from $10 million to $100 million, depending on the rocket’s payload capacity. A dedicated launch is beneficial only when the customer’s payload matches or is anywhere near the rocket’s payload capacity. This means customers don’t have to pay extra for unused space. The Starlink launch on Falcon 9 is a good example. Per one launch to LEO, SpaceX’s rocket deploys 60 Starlink satellites, weighing 15,600 kg. At the same time, Falcon 9 payload capacity to LEO is 22.8 tons.

Hosted payloads are not common because launch specifics do not imply any significant savings.

The most effective option is Rideshare. In this case, clients with the main and the additional payload both save money. Rocket Lab effectively carries out such launches, deploying several small satellites for different clients in a single launch. The downside of rideshare missions is that customers with additional payloads sometimes have to wait until the required payload mass is reached.

All new companies that are planning to enter the small satellite launch market design their carriers to accommodate rideshare missions. To this end, rocket fairings are divided into compartments, and the rocket itself can deploy payload to additional orbits.

Obviously, as the number of providers in the small satellite launch market grows, the competition will increase, too. Eventually, this will imply lower costs on launching one kg of payload. However, few will be able to compete with SpaceX in this regard. The company offers the smallest launch cost of just $2,500 per 1 kg. On the other hand, getting into the Falcon launch schedule is even more challenging. That is exactly where the small satellite launch market providers will come in.

Thank you for your comment! It will be visible on the site after moderation.