The Broken Economics of the Sutherland Spaceport

3rd Jul 2020

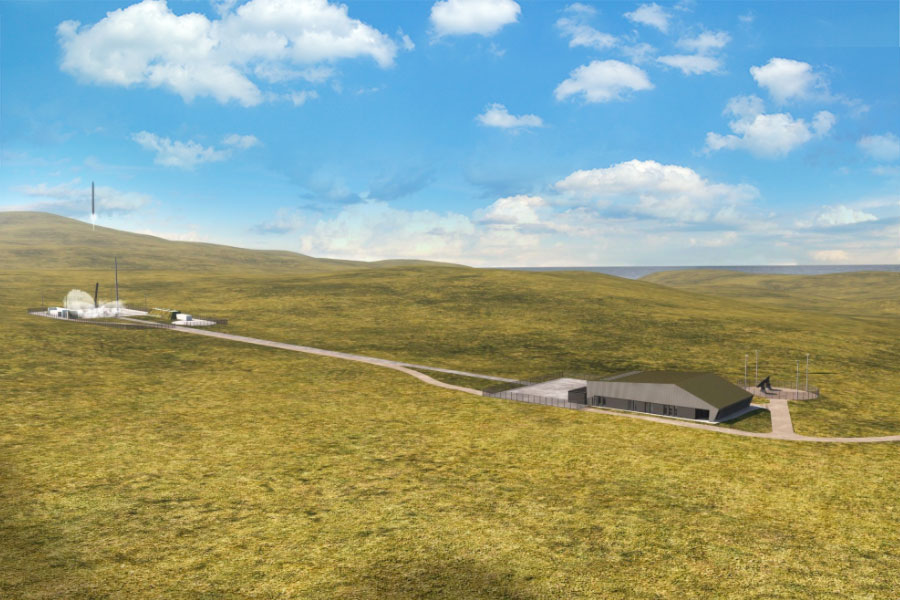

The proposed Sutherland Spaceport has been causing us some concern for quite a while now. For many reasons, but the main one being that it defies all common sense and logic. And we know that we aren’t alone in that view.

Even setting aside the ecological concerns and the secretive Danish company with no rockets, who have teamed up with America’s largest arms dealer… yes, even setting aside those concerns, the simple economics do not add up. We have covered this quite extensively in the past, where we have also referenced specific concerns over the financial viability of the project (and the value for money – or lack of – for the British taxpayer.

21st February 2020: https://orbitaltoday.com/2020/02/21/is-the-sutherland-spaceport-on-the-verge-of-collapse/

18th September 2019: https://orbitaltoday.com/2019/09/18/uk-space-ambitions-100-year-wait-until-sutherland-spaceport-see-a-return/

In fact, the economics of the Danish Orbex launch company don’t seem to add up either.

Every effort by us to get it to add up came to nothing. We got to a point where no amount of “creative accounting” would make it a viable commercial model. Eventually, our calculator gave up on us (or our accounting specialist took it out of the game through his own frustrations) and we seen that as a sign that it simply wasn’t possible.

So, let’s talk about the economics.

Fact 1: The planning application is for ONE launch pad

Fact 2: The conditions placed on the planning “approval” by Highland Council state there should be a maximum of 12 launches per year (one per month)

Fact 3: The amount paid by a company to have their satellite launched into orbit will be no more than £1m

*Reaches for calculator*

£1m x 12 = £12m annual income

Back in September 2019 we generously estimated an income of £10m per year. It seems we weren’t too far off the mark. That was back when they were referring to 20 launches per year and we made a more realistic estimate of 10. It turns out our estimate was closer to reality than the actually people managing the project. Maybe we should have sought out a consultation fee at that point.

The profit margin is likely to be around 10%, which would give us £1.2m in “actual” money per year. The rest being spent on operating costs, materials, fuel, rents and so on.

You could be forgiven for thinking that seems like a decent profit for the Danish launch operator. But when you consider they only recently borrowed £675k from Highlands & Islands Enterprise (and that’s before they have even got involved in any launch operations) it’s easy to see how quickly they could burn through that sort of cash.

Is spending £130m and getting a £1.2m annual return a good investment?

This question seems to have an obvious answer… or at least you would think so. But if the answer is so obvious then why isn’t it obvious to “everyone”?

Our estimate (based on input from field experts) suggests the cost of getting the Sutherland Spaceport up and running will end up around £130m (including the currently allocated grants) and as we have already pointed out the launch site will make a £1.2m profit per year, so it will take just over 100 years to break even. So, why would that be a good investment for either local or national government or a private investment company? We don’t know the answer and our guess is too unpalatable to publish.

Thank you for your comment! It will be visible on the site after moderation.